|

|

Wednesday, September 1, 2010

Thursday, June 3, 2010

Housing Stays Highly Affordable for Fifth Consecutive Quarter

RISMEDIA, May 29, 2010—Nationwide housing, bolstered by favorable interest rates and low house prices, hovered for the fifth consecutive quarter near its highest level of affordability since the series was first compiled 19 years ago, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index (HOI).

The HOI showed that 72.2% of all new and existing homes sold in the first quarter of 2010 were affordable to families earning the national median income of $63,800, slightly higher than the previous quarter and near the record-high 72.5% set during the first quarter a year ago.

“Today’s report is very encouraging because it indicates that home ownership continues its more than year-long trend of remaining within reach of more households than it has for almost two decades,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich. “With interest rates still hovering at low levels, companies starting to hire new employees and the economy beginning to rebound, this should encourage more home buyers to enter the market and help further stabilize housing and the economy.”

Indianapolis-Carmel and Youngstown-Warren-Boardman, Ohio-Pa., shared the ranking as the most affordable major housing markets in the country. In Indianapolis, which has held this top ranking for nearly five years, almost 95% of all homes sold were affordable to households earning the area’s median family income of $68,700. In Youngstown, the same percentage of homes were affordable to households earning a median $53,500.

Also near the top of the list of the most affordable major metro housing markets were Syracuse, N.Y.; Dayton, Ohio; and Grand Rapids-Wyoming, Mich.

Five smaller housing markets posted even higher affordability scores than Indianapolis and Youngstown. Among them, Bay City, Mich., where 98.7% of homes sold during the first quarter of 2010 were affordable to median-income earners, was the most affordable market in the country. Other smaller housing markets near the top of the index included Kokomo, Ind.; Davenport-Moline-Rock Island, Iowa-Ill.; Sandusky, Ohio; and Elkhart-Goshen, Ind., respectively.

New York-White Plains-Wayne, N.Y.-N.J., continued to lead the nation as its least affordable major housing market during the first quarter of 2010. Slightly less than 21% of all homes sold during the quarter were affordable to those earning the New York area’s median income of $65,600. This was the eighth consecutive quarter that the New York metropolitan division has occupied this position.

The other major metro areas near the bottom of the affordability scale included San Francisco; Honolulu; Santa Ana-Anaheim-Irvine, Calif.; and Los Angeles-Long Beach-Redwood City, Calif.

San Luis Obispo-Paso Robles, Calif. was the least affordable of the smaller metro housing markets in the country during the first quarter. Others near the bottom of the chart included Ocean City, N.J; Santa Cruz-Watsonville, Calif.; Napa, Calif.; and Flagstaff, Ariz.

For more information, visit www.nahb.org (http://www.nahb.org).

Monday, April 19, 2010

Vacant Homes are Not The easiest to sell

RISMEDIA, April 12, 2010—

1. People don’t simply buy houses; they buy the next chapter of their lives.

This is an emotional experience and emotion influences what people buy and how much they will pay. Vacant houses are devoid of life, and the chance to make an emotional connection is lost.

They wonder: "Is this a divorce? Why did they move out? Are they selling because they have money problems? Is this home hard to sell?" They’ll make a low-ball offer, thinking the owner is desperate. The buyer looks for issues instead of looking at the house. It is a distraction.

They look at nail holes, carpet wear and gaps in the molding rather than how the space works. In a vacant house, floors, walls and ceilings are all the buyers see. This drives the price down. Buyers look for things that would cause them not to buy, not at the things that drew them to the house. This creates objections.

An empty bedroom might appear awkward or a living room might seem cavernous. Some spaces might confuse buyers because a use is not obvious. Buyers are derailed and move on to the next house. When a home has furniture in it that is not to much, buyers can say " Our Couch is the smae size and would look the same there". They instead say, "Our Couch wont fit in that room"

Without people, even the best home quickly looks and smells vacant. Dust settles, leaves scatter, and stale smell spreads. These cues often shorten the showing time, leading to fewer sales.

"Home owners don’t realize how much harder a vacant home is to sell. In today’s market, you have to win the beauty contest," says Thomas Scott, VP of Marketing at Showhomes. "Vacant houses simply underperform staged homes and the increased sales price provides an excellent return on what staging costs. Choosing to stage your home should be an easy decision in today’s market."

Monday, April 12, 2010

Pending Home Sales Show some Spring in Gain

Pending Home Sales Show some Spring in Gain

Pending home sales rose in February 2010, potentially signaling a second surge of home sales in response to the home buyer tax credit, according to the National Association of Realtors. RISMEDIA, April 7, 2010

The Pending Home Sales Index (PHSI), a forward-looking indicator based on contracts signed in February, rose 8.2% to 97.6 from a downwardly revised 90.2 in January, and remains 17.3% above February 2009 when it was 83.2. The data reflects contracts and not closings, which usually occur with a lag time of one or two months.

Lawrence Yun, NAR chief economist, said the improvement is another hopeful sign. "The rise in buyer contact activity may signal the early stages of a second surge of home sales this spring. The healthy gain hints home prices are continuing to flatten," he said. "We need a second surge to meaningfully draw down inventory and definitively stabilize home values."

The PHSI in the Northeast rose 9.0% to 77.7 in February and is 18.9% higher than February 2009. In the Midwest the index jumped 21.8% to 97.9 and is 18.7% above a year ago. Pending home sales in the South increased 9.2% to an index of 107.0, and the index is 17.5% higher than February 2009. In the West the index fell 4.8% to 98.0 but is 14.6% above a year ago.

"Anecdotally, we’re hearing about a rise of activity in recent weeks with ongoing reports of multiple offers in more markets, so the March data could demonstrate additional improvement from buyers responding to the tax credit," Yun said.

Saturday, April 3, 2010

SC Senate to vote on Cigarette Tax

Numerous amendments to the bill were considered on Wednesday, including a failed amendment offered by Senator Bright that would have directed cigarette tax revenue towards commercial property relief. Other amendments offered would have directed the revenue to public schools, the court system and aviation incentives; they were either tabled, withdrawn or failed to receive approval.

Sunday, February 14, 2010

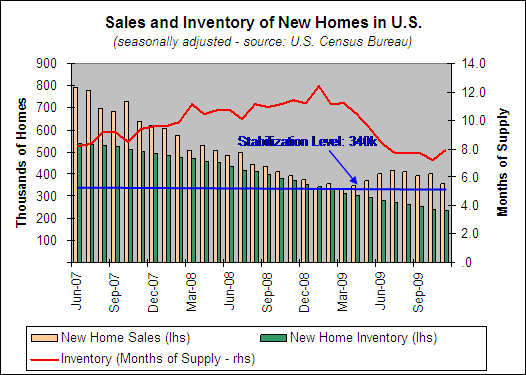

Housing supplies steadily declining

New data from Altos Research shows that housing supplies have been steadily declining for the last 16 months. The company says there are 20 percent fewer homes for sale now than there were in 2008. Some fear this decline is because banks have been holding back their repossessed properties, but Altos doesn't expect this so-called shadow inventory to result in a real estate day of reckoning in 2010 as some market observers have warned.Scott Sambucci, VP of data analytics at Altos Research, says the industry won't see any effects from the supply of homes lurking in the darkness until inventory levels pick up. And he doesn't foresee that happening anytime soon, primarily because banks have no immediate motivation to offload these assets from their balance sheets, and are keenly aware that a sudden jump in the number of homes on the market could be detrimental to already-fragile property values. With a smaller selection of inventory, buyers will pay a higher price-the rudimentary concept of supply and demand. Sambucci says he's already seen definite evidence of a price floor in 2009. Home price statistics started out 2010 on a good foot, according to Altos' data, with seven-day moving averages within the company's index bouncing off their lows and starting to tick up. In addition, the number of homes with price reductions and the magnitude of these discounts are diminishing, although Sambucci says that could indicate buyers' willingness to pay more or it could just mean sellers are becoming more realistic about what they can get. Either way, price reduction stats, while still elevated, are moving in the right direction, he says.Altos' researchers expect to see some seasonal bounce back in prices and short-term strength in the coming months as a result of government stimulus, such as the homebuyer tax credit and the last of the Federal Reserve's purchases of mortgage securities. But Sambucci says that momentum will likely fall off toward the latter half of 2010, and any price gains seen this year will be lost as the government programs wind down. Altos Research expects home prices to start 2011 at the same level they are now in early 2010. Sambucci explained that if inventory continues to decline, by next year price points should become more attractive and activity can still be sustained.

Source: DSNews.com, Carrie Bay (01/27/2010)

Sunday, February 7, 2010

Housing starts decline, permits rise

Nationwide housing production fell four percent in December to a seasonally adjusted annual rate of 557,000 units, according to data released today by the U.S. Commerce Department. Meanwhile, permit issuance, which can be a future sign of housing activity, rose 10.9 percent last month to a seasonally adjusted annual rate of 653,000 units. Single-family housing starts fell 6.9 percent in December to a seasonally adjusted annual rate of 456,000 while multifamily starts posted a 12.2 percent gain to a seasonally adjusted annual rate of 101,000 units.Single-family permits rose 8.3 percent to a seasonally adjusted annual rate of 508,000 units in December while multifamily permits were up 20.8 percent to 145,000 units. On an annual basis, year-end figures from the Commerce Department show that overall housing starts declined 38.8 percent to 554,000 units. Single-family starts were down 28.7 percent for the year to 444,000 units while multi-family starts declined 61.1 percent to 110,000 units." These figures give us the first estimate of the worst year we've seen for housing production since the Census began recording these numbers," said NAHB Chief Economist David Crowe. "We remain cautiously optimistic about a recovery in 2010, as job growth begins to show positive signs by mid-year." Regionally, housing starts in December were down 19 percent in the Northeast, 18.5 percent in the Midwest and 0.9 percent in the West. The South posted a 3.3 percent gain.

Thursday, February 4, 2010

Mixed messages for home price

Data through November 2009, released today by Standard & Poor's for its S&P/Case-Shiller Home Price Indices show that the annual rates of decline of the 10-City and 20-City Composites continue to improve, in spite of price declines being measured across many markets during November. This marks approximately 10 months of improved readings in the annual statistics, beginning in early 2009, and is the third consecutive month these statistics have registered single digit declines, after 20 consecutive months of double digit declines. Four of the markets-Charlotte, Las Vegas, Seattle and Tampa-posted new low index levels as measured by the past four years. In other words, any gains they might have seen in recent months have been erased and November is now considered their current trough value. On the flip side, there are still some markets that continue to improve month-over-month. Los Angeles, Phoenix, San Diego and San Francisco have seen prices increase for at least six consecutive months. Looking at the annual figures, four markets-Dallas, Denver, San Diego and San Francisco-have finally entered positive territory, something we really haven't seen in at least two years in most markets. Charlotte, Las Vegas, Seattle and Tampa all reached new low levels in November. For Las Vegas, in particular, prices have declined for 39 consecutive months, with a peak-to-trough reading of -55.6%. It is now just 4% above its January 2000 level. This compares to its peak in August 2006, when the average home price was 135% above that same level.

Tuesday, January 12, 2010

Columbia, SC The State Capital

Area Population: 576,557

Area Households: 223,500

Household Growth Rate: 7.45% (projected 2006-20011)

Households with Children: (Younger than age 18) 36.8%

Households Owned: 69.1%

Median Value of Owned Homes: $121,762

Average Household Income: $62,501

Median Household Income: $47,821

Education: (Columbia Metro, which includes Richland and Lexington counties)25.6% have high school degrees21.7% have some college education27.2% have associate or bachelor's degrees10.2% have advanced degrees

Ethnic Makeup: 61.9% white; 33.3% African American; 0.3% American Indian and Alaska Nat.; 1.6% Asian; 0.1% Nat. Hawaiian and other Pacific Islander; 1.3% other; 1.6% two or more races

Median Age: 35.3 years

Average Rent: $826

Climate: A temperate climate year-round, averaging 82 degrees in summer, 53 degrees in

winter; average annual rainfall 50 inches

Major Employers/Industries: Palmetto Health, 7,500 employees; Blue Cross Blue Shield of South Carolina, 5,100 employees; University of South Carolina, 1,621 employees; Richland School District #1, 5,000 employees; SCE&G, 4,000 employees; UPS, 3,528 employees; Wachovia Bank, N.A., 3,422 employees; Richland School District #2, 2,500 employees; Fort Jackson, 4,200 employees; South Carolina State Government, 30,753 employees

Culture: Koger Center for the Arts, a $15 million complex; The Columbia Museum of Art; South Carolina State Museum; Carolina Coliseum; the new Colonial Center; 11 theater groups including professional theater; professional ballet troupe and numerous other dance companies; opera; symphony; The Township, which has hosted cultural events in Columbia since 1929.

Major Community Events: First Ladies' Walk for Life: Steps Against Breast Cancer; Summer Concert Series; Central Carolina Community Foundation's International Festival of Food and Wine; South Carolina State Fair; Palmetto Health Children's Hospital's Festival of Trees; Junior League of Columbia's Clean Sweep Sale; Columbia Festival of the Arts; Home Builders Association of Greater Columbia's Home and Garden Show; Black Expo

Famous Citizens: Coach Steve Spurrier; anchor Rita Cosby; Leeza Gibbons; astronaut Charles Bolden; the late novelist and poet James Dickey; novelist William Price Fox; the late Republican National Committee Chairman Lee Atwater; Miss America Kimberly Aiken; Hootie and the Blowfish; actress Kristen Davis; Strom Thurmond; Jesse Jackson; the late James Brown; comedian Steven Colbert

Sunday, January 10, 2010

Although short sales are likely to increase in 2010, the jump in these transactions is unlikely to have any real impact on the housing market, according to a new study by Housing Predictor. While more at-risk homeowners are turning to short sales as an alternative to foreclosure, Housing Predictor says the small number of short sales that are actually approved by banks represent less than 1 percent of all homes facing foreclosure. In the first half of 2009, only 40,000 short sales were completed, according to the most recent data available from the Office of the Comptroller of Currency shows.In addition, Housing Predictor said only an estimated 8 to 12 percent of all homeowners who request short sales accomplish a completed transaction. Because lenders only write off short sales as a loss when a property is sold, this small percentage of completed transactions leaves a gaping hole in the troubled banking industry's problem with short sales.

Source Real Trends

Tuesday, January 5, 2010

Snap Shot look at Short Sales

There is some great issues with banks and learning the systems of "Short Sales" but over the last year. The banks have not been willing to work with the consumers. The banks are not willing to be timely with the getting information to the new buyers. The banks are not willing to work with in a timely manor with the sellers.

There is some great issues with banks and learning the systems of "Short Sales" but over the last year. The banks have not been willing to work with the consumers. The banks are not willing to be timely with the getting information to the new buyers. The banks are not willing to work with in a timely manor with the sellers.Studies have shown that it costs the bank more money if a property was foreclosed upon than if they accepted a 'short sale'. For homeowners, a 'short sale' makes much more sense for several reasons:

1- There is a much higher chance that the deficiency judgment could be negotiated in a short sale versus a foreclosure.

2- A short sale would have less of a negative impact on the homeowner's credit rating.

3- The homeowner would have at least some control over the timing of their relocation to new living arrangements.

4- A 'short sale' would allow the homeowner to leave with dignity.

5- It does not leave a house vacant for a year or more and bring other bank owned homes value down due to condition of subject property.

6- And Finally it just makes sense ( Banks don’t get it)

In the past, the banks used to process the loan (take the application, put together the file, etc.), lend you the money, and service the loan (send the bills, make collection calls, follow-up, etc.).

In the past, the banks used to process the loan (take the application, put together the file, etc.), lend you the money, and service the loan (send the bills, make collection calls, follow-up, etc.).Over the last eight to ten years, the lending of mortgage money has shifted. First Wall Street and then the federal government became the primary lender in the mortgage sector. But, neither Wall Street nor the government had any interest in processing or servicing the mortgage. Mortgage companies continued to process the loans, but a new industry was created to fill the need for the servicing of these loans. So now, a separate and independent entity is servicing a tremendous portion of existing mortgages.

Just ten years ago, 37.4 percent of all mortgage loans were securitized (thus requiring a servicing company). Today, that number is 79.3 percent. Servicing companies actually collected more fees for a foreclosure than they did for a 'short sale'. Actually, the servicing company would lose money if they did a 'short sale'.

The federal government realizing that modifications were not the answer and banks realizing that the foreclosure process was too expensive, have agreed to change the fee structure to make it more profitable for the servicing companies to lean toward 'short sales'

Now knowing that information the process for short sales over the last 6 months to a year have become easier on everyone with one exception. While the process is easier, the volume has increased to the point that customer service has been thrown out the window and time of the essence is not spoken of.

My advice:

1- If you are in the need of a short sale, contact someone locally to help you through the process ( Loss Mitigation Specialist or an attorney). I can recommend someone to you if you need that assistance.

2- If you are interested in purchasing a Short Sale home, understand the process and understand it takes time and 85% of the time the delays are not the agents, or sellers fault. However, work with an agent that has done these type of transaction before. I can recommend someone to you if you need that assistance.

Friday, December 18, 2009

Short Sales information, Columbia Homes

The other option that few consider is to rent your house. In many cases you may get a considerable down payment and perhaps a little more than your actual mortgage. If you need assistance to rent your house consult a property manager and notify your lender.

Earlier this week, mortgage giant Fannie Mae said homeowners who stop making payments and then send their keys back to lenders months later will not be able to get another mortgage through that firm for five years. Freddie Mac also is going after walk-away borrowers, mortgage lenders say. Neighbors of the people who walk way are already being punished by lower home values due to the foreclosure. "People should hang in there as long as they can, ask for help and try to work with their lender,"

Edwin Gerace's Lexington SC Real Estate Blog

About Me

- Lexington Real Estate with Edwin Gerace

- Lexington, SC, United States

- Edwin Gerace is Realtor with Holiday Builders in Lexington South Carolina. Edwin specializes in New Construction and 1st Time Home Buyers. Edwin is very active in Lexington South Carolina and is knowledgeable about the surroundings. Edwin is very active in his profession and community such as: On active committees with the Columbia Home Builders, active and on committees with Lexington Chamber of Commerce, Town of Lexington Performing Arts Center, Green Building Council of HBA, LORADAC, State Association of Realtors on State and Local Level, and many other community oriented service groups.